Suvit Review: Accounting Automation for Modern Finance Teams

If you’re searching for suvit, chances are you’re an accountant, finance professional, or business owner looking to reduce manual work in accounting and bookkeeping.

For many teams—especially in India—tasks like invoice entry, document handling, and GST reconciliation still consume hours every week. Automation tools promise relief, but not all of them are built with local compliance, accounting workflows, or tools like Tally in mind.

That’s where Suvit positions itself.

This article gives you a clear, practical explanation of what Suvit does, how it works, who it’s best for, where it falls short, and how it compares with other accounting automation platforms.

Table of Contents

What Is Suvit?

Suvit is an accounting automation software designed to help accountants and finance teams automate repetitive tasks such as:

-

Data entry from invoices and documents

-

Organizing accounting files

-

Supporting GST-related workflows

-

Integrating with accounting systems like Tally

In simple terms, Suvit helps finance teams spend less time typing data and more time reviewing and analyzing it.

It is not a full accounting system like Tally or Zoho Books. Instead, it works alongside them to automate manual steps.

Why Suvit Exists

Many accounting teams face the same challenges:

-

Large volumes of invoices and bills

-

Manual data entry into Tally

-

Errors caused by repetitive typing

-

Time-consuming GST preparation

-

Difficulty managing documents across clients

Suvit was built to reduce this operational friction, especially for Indian accounting firms handling multiple clients.

Who Is Suvit Designed For?

Suvit is best suited for:

-

Chartered Accountants (CAs)

-

Accounting firms managing multiple clients

-

Small and mid-sized businesses using Tally

-

Finance teams handling high document volumes

-

Professionals working with GST data regularly

It is particularly relevant in India, where GST compliance and Tally usage are common.

Who Should Avoid Suvit?

Suvit may not be the right choice if:

-

You need a full ERP or accounting system

-

Your business doesn’t use Tally or similar tools

-

You require advanced international tax automation

-

You need deep financial analytics or forecasting

In those cases, broader finance platforms may be a better fit.

Key Features of Suvit Explained

Let’s break down Suvit’s core features in practical terms.

1. Automated Data Entry

Suvit reduces manual entry by extracting data from invoices and documents, helping accountants avoid repetitive typing.

2. Document Management

Bills, invoices, and files can be organized digitally, making retrieval easier during audits or reconciliations.

3. Tally Integration Support

One of Suvit’s strongest selling points is its compatibility with Tally-based workflows, which many Indian firms rely on.

4. GST Workflow Assistance

While Suvit is not a GST filing tool itself, it supports cleaner data preparation, making GST reconciliation smoother.

5. Multi-Client Handling

Accounting firms can manage documents and data across multiple clients without mixing records.

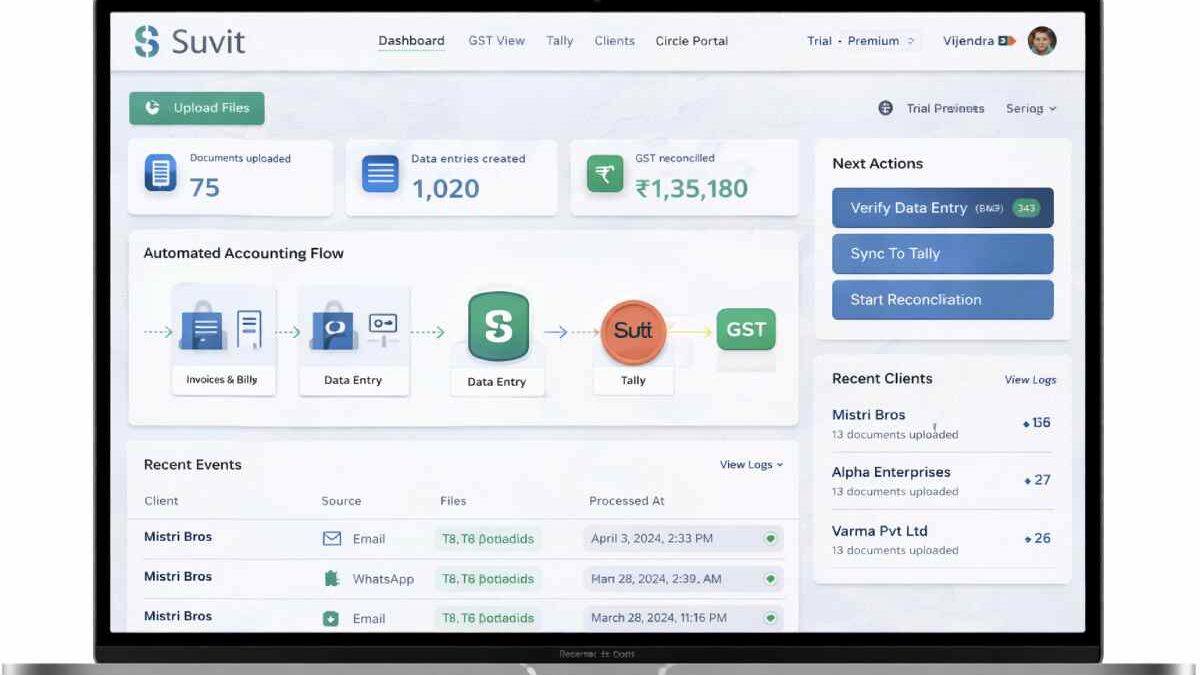

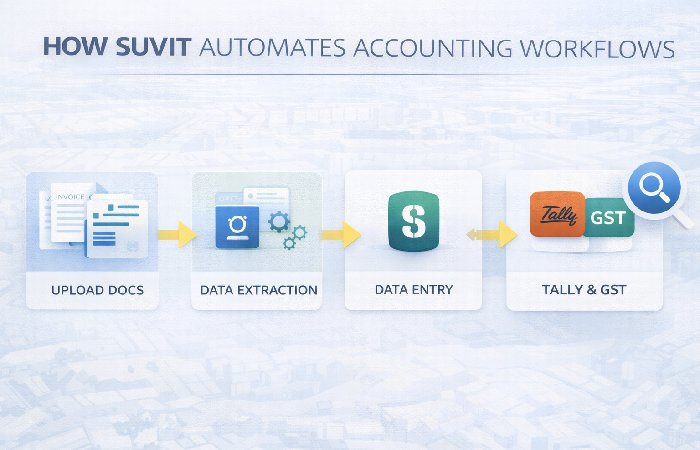

How Suvit Works

Here’s a simplified view of how teams typically use Suvit:

-

Upload or collect accounting documents

-

Suvit processes and extracts relevant data

-

Accountants review and verify entries

-

Clean data is synced or prepared for Tally

-

Data is used for accounting or GST processes

The goal is not to remove human review—but to remove unnecessary manual effort before that review.

Real-World Use Cases

Accounting Firms

Firms handling dozens of clients use Suvit to reduce turnaround time during peak filing seasons.

Small Businesses

Businesses with limited accounting staff use it to keep records organized without hiring extra help.

GST Preparation

Cleaner, structured data helps reduce mismatches and last-minute corrections.

From practical observation, tools like Suvit are most valuable during high-volume periods, such as monthly closures or GST deadlines.

Benefits of Using Suvit

Users typically choose Suvit for these reasons:

-

Reduced manual data entry

-

Fewer accounting errors

-

Better document organization

-

Faster turnaround times

-

Improved accountant productivity

For many teams, the biggest win is time saved, not just automation.

Limitations and Drawbacks

No tool is perfect. Suvit has some limitations worth noting.

1. Not a Full Accounting System

You still need software like Tally for core accounting.

2. Learning Curve

Teams may need time to adjust workflows and verification processes.

3. Pricing Transparency

Exact pricing may not always be clearly listed publicly and often depends on usage or scale.

4. Regional Focus

Suvit is optimized for Indian accounting workflows, which may limit global applicability.

Suvit Pricing: What to Expect

It generally follows a business-focused pricing approach, where costs may depend on:

-

Number of users

-

Volume of documents processed

-

Firm size or client count

-

Required integrations or support level

For accurate pricing, most businesses need to request a quote based on their specific needs.

Pricing Tip

Before committing, estimate:

-

Monthly document volume

-

Number of clients

-

Peak workload periods

This avoids surprises later.

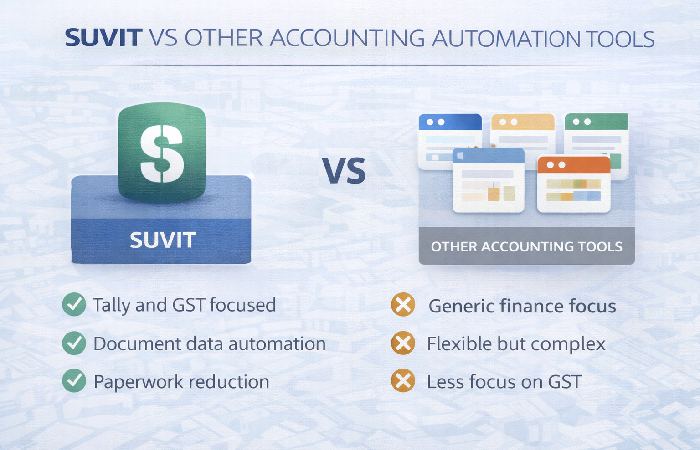

Suvit vs Other Accounting Automation Tools

Here’s how Suvit compares at a high level.

Suvit vs Generic Automation Tools

Generic automation platforms are flexible but often lack accounting-specific logic.

Suvit vs Full Accounting Software

Full accounting tools handle books but don’t focus on reducing data-entry workload as deeply.

Suvit vs Global Finance Platforms

Global tools may offer advanced analytics but often lack GST and Tally alignment.

Suvit’s strength lies in its niche focus, not broad coverage.

Common Mistakes Businesses Make

Many teams fail to get full value because they:

-

Expect full automation without review

-

Skip proper setup and verification steps

-

Don’t train staff adequately

-

Use it only for a small part of workflows

Automation works best when paired with clear internal processes.

Myths vs Facts About Suvit

| Myth | Fact |

|---|---|

| Suvit replaces accountants | It supports accountants |

| Suvit files GST returns | It prepares data |

| Automation removes all errors | Review is still required |

| It works without setup | Proper configuration matters |

Practical Tips for Using Suvit Effectively

-

Start with one workflow (e.g., invoice entry)

-

Train staff on verification steps

-

Monitor accuracy before scaling

-

Integrate gradually with existing tools

-

Use reports to spot recurring issues

In practice, slow and steady adoption works better than a full switch overnight.

Suvit Alternatives to Consider

Depending on your needs, you may also explore:

-

Other accounting automation tools

-

Full accounting suites with automation add-ons

-

ERP systems for larger organizations

Each option has trade-offs in cost, complexity, and flexibility.

FAQs About Suvit

What is Suvit used for?

Suvit automates repetitive accounting tasks like data entry and document handling.

Is Suvit suitable for small accounting firms?

Yes, especially firms handling multiple clients and GST workflows.

Does Suvit replace Tally?

No. It works alongside Tally.

Is Suvit only for India?

It is primarily optimized for Indian accounting practices.

Is Suvit easy to use?

It requires setup and training but is manageable for finance teams.

Final Conclusion

Suvit is a focused accounting automation platform built for finance professionals who want to reduce manual work without replacing their existing accounting systems. For Indian accountants and businesses using Tally and handling GST workflows, Suvit can offer meaningful efficiency gains when implemented correctly.

If your goal is less data entry, fewer errors, and better use of accounting time, Suvit is worth serious consideration.